Curve is a physical Mastercard that you can use in front of your existing debit and credit cards. Select in the app which existing card it should use and Curve will pass on the transaction to that card - and even exchange for free if a foreign currency is involved. You could leave all your cards at home and just keep the Curve card with you. In fact, keep the card at home and just use Google, Samsung or Apple pay!

How it works

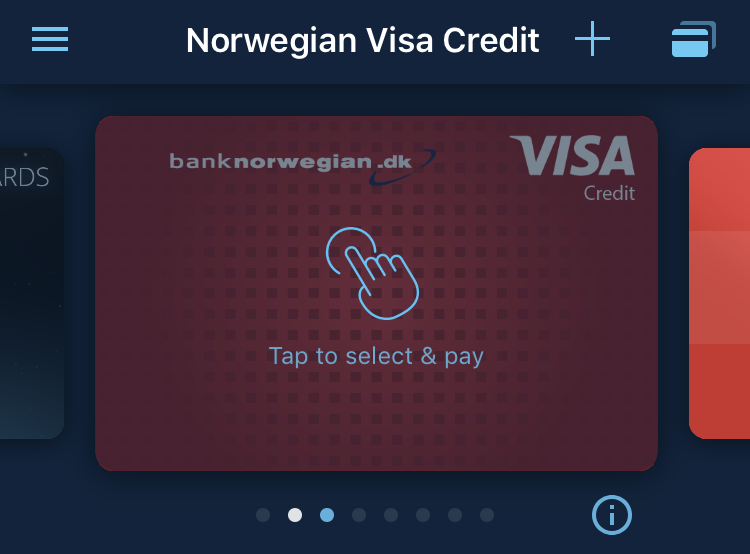

Curve by itself is not a credit / debit card, you need at least one underlying funding card which is any existing credit / debit card you own in your own name. You download the Curve app and start scanning all the cards you want to proxy. Use my code D6AAROGE to get a £5 starting bonus! After adding all the funding cards you need you can choose which funding card you want active and ready to use when you use your Curve card.

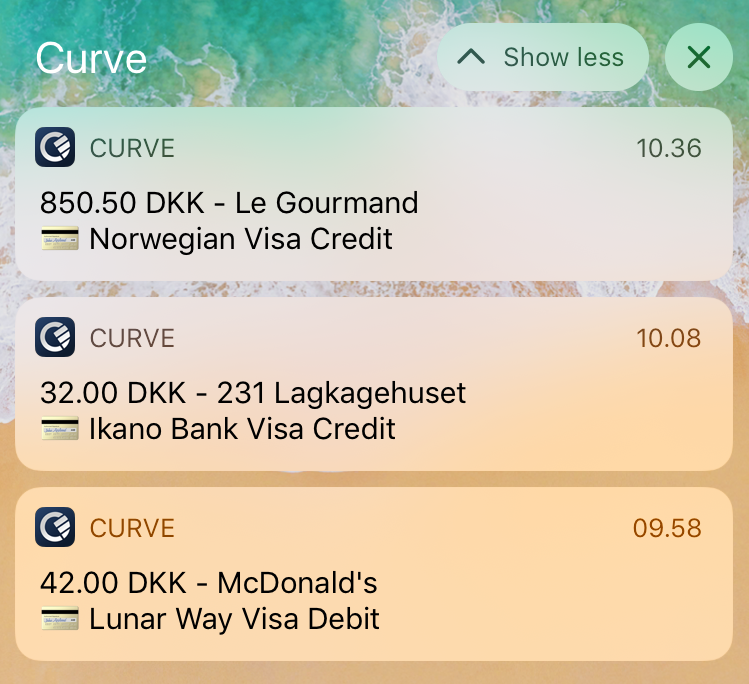

First time do use the pin & chip method before using the wireless NFC1 option. When using the Curve card, you will see a matching transaction on your funding card starting with “CRV-“ and ending with “LONDON” or “VILNIUS” depending on where you card was issued. E.g.

CRV-MCDONALDS HOVEDBANE, LONDON

Then switch the funding card from the app, make another purchase and the correct funding card is now charged! The Merchant Category Code (MCC)2 is passed on to the funding card which means if will correctly get cashback3 / points if you funding card supports this.

If you choose a wrong funding card and purchase something, you can use the time travel function to charge another funding card. This can be done on transaction up to two weeks old, but only once per transaction.

An added bonus is it is very nice to have single overview of all my purchases across all funding cards in the Curve app.

The app does a good job at giving instant notification on purchases with just the right amount of information - amount, vendor and card used.

Features

- One single Curve card to use and manage all Visa and Mastercards - including Danish Visa / Dankort combination cards.

- Unified overview of all spendings.

- Fee free exchange up to £500 per month (free tier) on weekdays.

- Adding NFC to cards that do not support it.

- Adding Google, Samsung and Apple pay to cards that do not support it.

- Time travel trickery with underlying cards, a fantastic tool to optimise cashback rewards.

- Only need to replace one card in case of fraud.

- Supports 3D Secure authentication

Limitations

- Single point of failure - if Curve card / app is down, then it affects all funding cards if you keep them at home.

- Using the free tier of Curve, there are some spending / withdrawal / exchange limits. All of these are shown in the app, except the £500 per month exchange limit before paying 2% exchange fees.

- The cashback from Curve is limited to the first 3 months on the free tier.

- Using Curve with a credit card as a funding card removes the section 75 protection (you will still get MasterCards chargeback protection)

- Only Visa and Mastercard cards are supported as funding cards. Amex4 cards used to be supported, but support has been withdrawn from Amex since. Danish hybrid Visa / Dankort also works as a funding card, but only uses the Visa part of the card.

- Changing the Curve cards pin code is done at a “Mastercard certified” ATM and not in the app like other cards. I have successfully done this in Denmark using an Euronet ATM which are placed in tourist areas.

- Time travel can only be used once per transaction so do not make any mistakes.

- When purchasing something where the transaction does occur at the time of purchase (e.g. Amazon.com charges when goods are sent, not when they are purchased) it will use the funding card chosen at the time of sending and not time of purchasing. This is where the time travel function comes in handy if you do it within 2 weeks and the purchase is below £1000.

- No internet, no way to switch funding cards or time travel until you have internet again.

-

When using the Curve to exchange currencies to match the funding card, you need to be aware of the €500 monthly limit before they charge a surcharge. Also when doing this during the weekend you will get an additional surcharge even if you are not over the limit!

From Fridays at 23:59 to Sundays 23:59, the UK foreign exchange markets are closed. During this time, we take the rate from Friday and charge an additional 0.5% for all transactions made in GBP, EUR and USD and 1.5% for all other supported currencies.

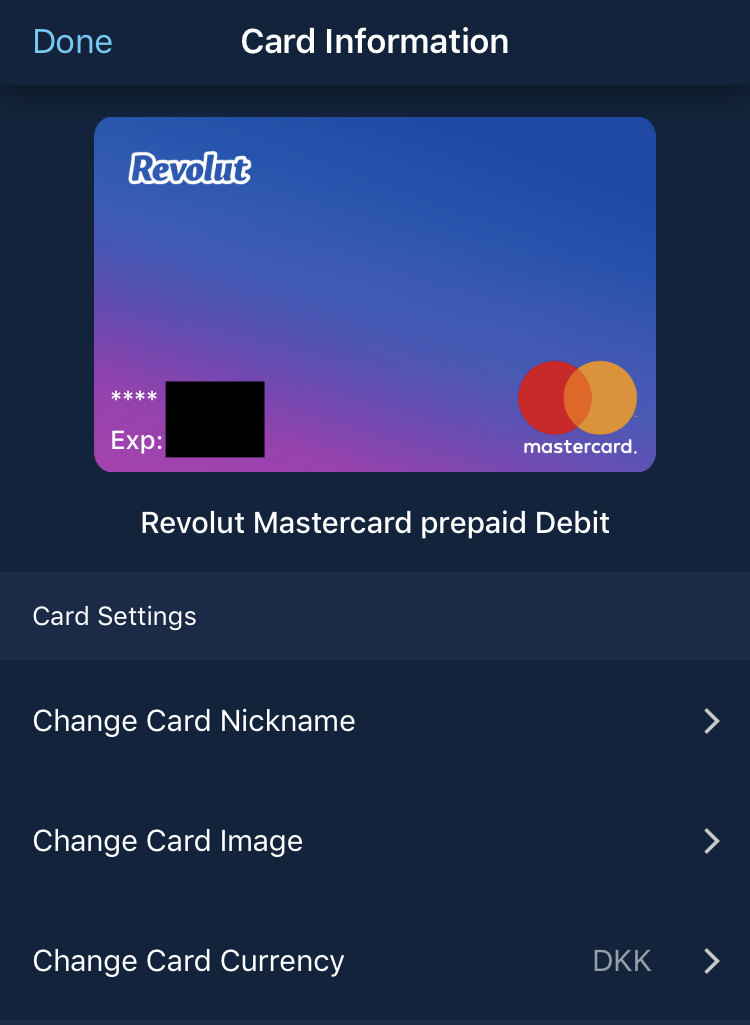

- When using a multi-currency funding card like Revolut or Transferwise, you need to change the funding cards currency to match your purchase. If you forget you might be saved by Curves own exchange which when below the monthly limit and during weekdays are fee free and at interbank rates5. It does not get better than this for consumers. Else you might be able to use time travel to another multi-currency card with the correct currency set, but I have not tried this, but it should work.

How I am using the card

This is my main card and eliminates the need for other cards. With the introduction of Google, Samsung and Apple pay I honestly do not need to carry it with me anymore, but I always keep at least one backup card from another network like Visa. The greatest change to my card usage over the past year has been to always use my Curve card and then once a week time travel purchases over to the correct cashback card. I never consider which funding card to use in the store. I just set the funding card to the one I use most and I am good to go! This works great on vacation where I do not always have internet. When back at the hotel I time travel the few purchases that needs to be on another card.

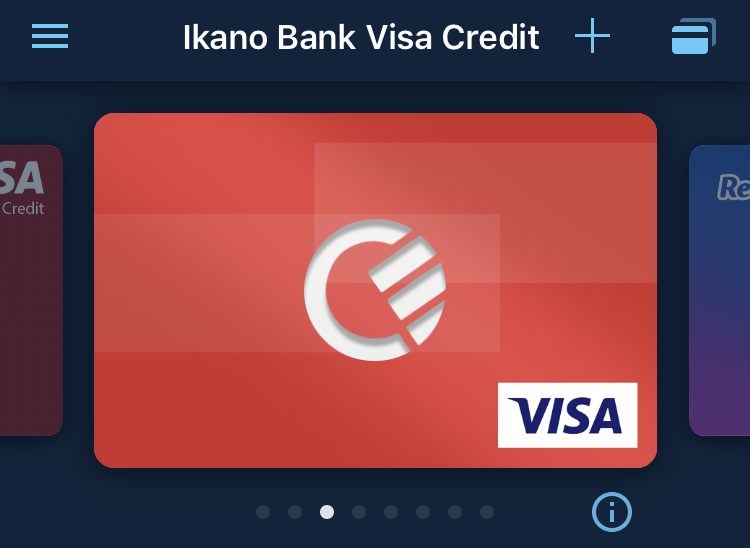

I also started to replace my N26 / Revolut / Transferwise card for foreign purchases as I can use my Danish cashback / points funding cards like Norwegian and Ikano Bank to get zero exchange fees at interbank rates and the added bonus of points and cashback! This is especially handy for the Ikano Bank card as it has 5% cashback on cafés and restaurants. The cards foreign transaction fees6 are

- 1,75% (from Ikano Bank)

So without Curve as a proxy the actual cashback is only 3,25%. To work around the €500 monthly exchange limit I use two Curve cards - my own and my wife’s. If it is possible to upgrade the card for a single month to avoid this limit I would consider it during shopping trips or large online purchases.

This card has been great to add NFC, Google pay, Samsung pay and Apple pay capability to my funding cards that do not support it yet. Ikano Bank which does not have NFC, has only been used through Curve since I added the card.

Curve has a limited number of ATM withdrawals before they start charging you. However, they have 10 fee free local ATM withdrawals. As long as Curve does not exchange anything for you, but just passes the ATM transaction to your funding card, you have a local withdrawal. To force this in Curve you simply set the funding card to the currency you are withdrawing. To quote Curve:

We do not charge a fee if your payment card is set to the same currency that you are withdrawing (i.e. your card is set to EUR currency and you are withdrawing EUR).

So any card can be used, but in order to minimise the exchange fees from the funding card you should:

- Use a multi-currency cards like Revolut and Transferwise.

- Use a card with low or no exchange fees like N26.

Recently I just use my N26 euro card as a funding card to make these withdrawals and let N26 exchange for me since they use a very fair Mastercard mid-market rate which seem to be at 0,25% compared to the interbank rate. Revolut is cheaper only when

- You are exchanging in a weekday

- You are under the monthly exchange limit

- You are avoiding illiquid currencies with extra markup like Russian Ruble or Thai Baht.

And Transferwise is generally more expensive.

You might be able to get additional points on your Curve card and underlying Mastercard funding card for free if you live in a Mastercard priceless specials city or country, e.g. Poland or Germany. You get one (or two if you use a Mastercard funding card) coins per purchase that can be redeemed for discounts, goods or services. It does not exists in Denmark, but I did manage to use my packaging forward address in Germany from mailboxde.com to get into the German Priceless Specials program.

-

Near-field communication (NFC) is a set of communication protocols that enable two electronic devices to establish communication by bringing them within 4 cm of each other. NFC devices are used in contactless payment systems, similar to those used in credit cards and electronic ticket smartcards and allow mobile payment to replace or supplement these systems. ↩

-

A Merchant Category Code (MCC) is a four-digit number for retail financial services. MCC is used to classify the business by the type of goods or services it provides. MCCs are assigned by merchant type (e.g. one for hotels, one for office supply stores, etc.) or by merchant name (e.g. 3000 for United Airlines). ↩

-

A small amount paid to a customer by the credit / debit card company for each use of a card. ↩

-

American Express Company, also known as Amex. Issues credit cards like Visa and Mastercard. ↩

-

The interbank rate is essentially the rate at which banks exchange currencies with one another. ↩

-

A foreign transaction fee is typically made of two parts. First, there is a currency conversion fee, which is charged by the card network, such as Visa or Mastercard. Both charge 1%. There is also an extra fee added by the card issuer. This is typically about 1 or 2 percent in Denmark, although it varies based on the issuer and the card. ↩